Lib45.a

Liberty 45

I want to be a freelancer at the age of 30. It happened at the age of 31 because of xmas vacation.

Now I am 45 and I am targeting Liberty 45 which I call Lib45.a!

This version (Lib45.a) is a blend between semi-retirement, freelance, Barista FIRE and other FIRE movements...

It seems that every chapter or big change in my life are about ~7-8 years:

- 2003: First IT job

- 2011: Became a freelancer

- 2018: Moved and worked in USA (Twitch, Reddit, Riot)

- 2025: Lib45.a

Of course, there are also some side-quests between those dates:

- 2005: Dreaming job a.k.a worked in a Gaming company

- 2007/2008: Worked and traveled around the world for the job (e.g. Italy, Japan, ...)

- 2012: Released one of my major app

- 2014: Awesome contract in New York city and released an indie game on Steam

- 2022, 2024: XXX/YYY projects (related to Lib45.a)

...

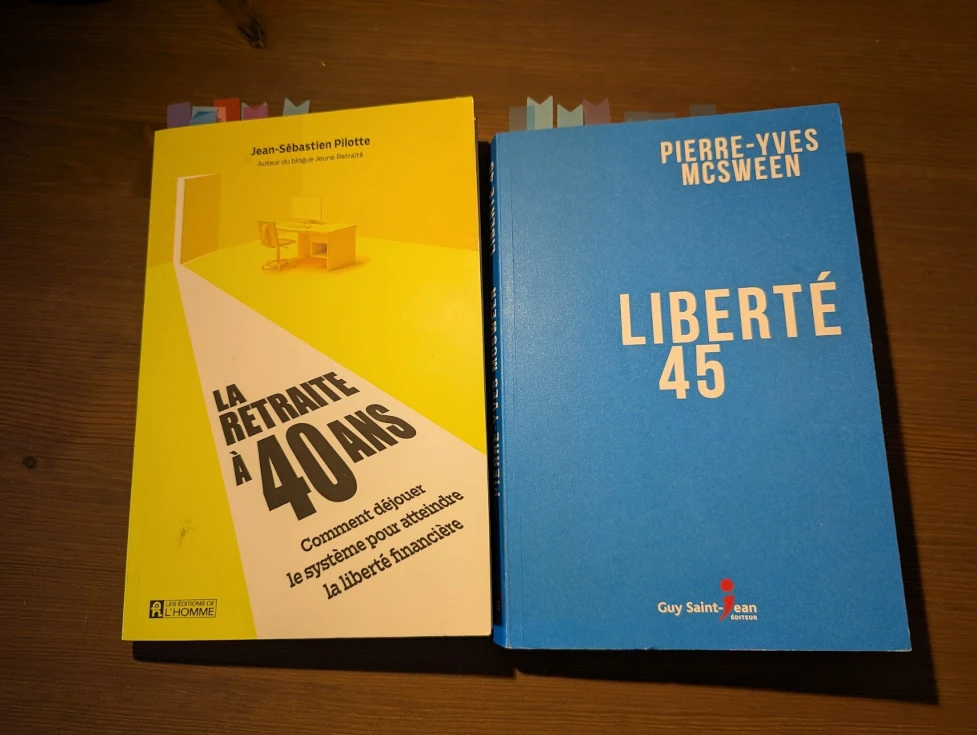

Books

Above are 2 books that helped me for my Lib45.a. It's in french but there are a couple of similar books (or websites) that are also useful like that in english or other languages.

The left book is "Retirement at 40 years old." and talked about the rat race, being the CEO of your life, doing a budget, 4% rule, how he retired at 39 instead of 45, travel, stress, plan-b and finance.

There is an interesting part in the book where he said that people reacted strangely when he said it will retire soon ("crab bucket" that he also mentioned this pattern in his book).

Crab Bucket / Crab mentality is the idea that if one crab tries to climb out of a bucket, the others will pull it back down, so none escape a.k.a people who sabotage others' success out of jealousy, resentment, or fear of being left behind.

The second book is Liberty 45 and talks about financial freedom as taking control of your financial life to give you more freedom.

Other topics covered like budget, have a plan and he really focus on saving money and investing when you are young (20-30) for later.

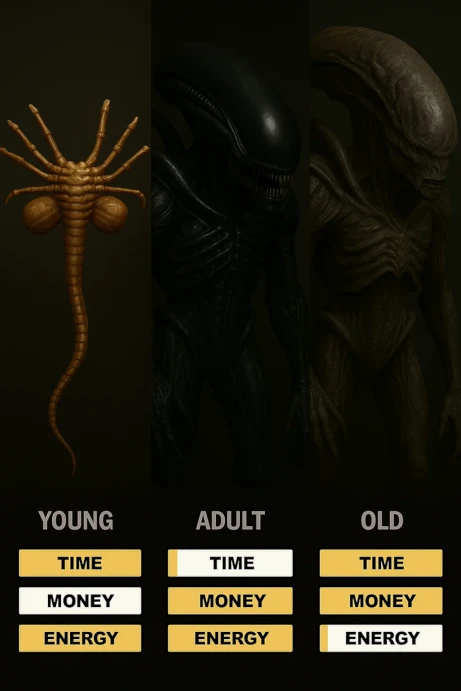

Also the book explained the difference between age 25, 45 and 65 which is like the picture above. When you are 25, you have a lot of time but not really cash. 65 is more cash but less energy. 45 is the sweet spot because you are still young and have cash (if you invested before).

He mentioned that at 45 is a good time to slow down and to carry out the projects that are close to our hearts. Take a career break, new life choices, start the transition plan towards "financial retirement".

He proposed a plan called VEI where you focus on increasing your value, save massively (20-50%) and invest wisely.

One quote I like in his book is: "If you find something better elsewhere, leave."

It's the second book of the author. The first book is also very good called "Do You Really Need It?: One Question to Free You Financially" available in French, Spanish, German and English.

There are a lot of websites and videos where you can learn more about those topics.

If you have some debt, there is Dave Ramsey's Baby Steps with his 7-step plan for getting out of debt, building savings, and building wealth.

I would say that the 3 main and common ideas that people share including Ray Dalio, Dave Ramsey and others are:

- Live on less than you make

- Get on a budget

- Stay out of debt

F.I.R.E

FIRE acronym is for Financial Independence, Retire Early!

There are multiple variations:

Lean FIRE: Minimalist retirement with very low expenses. Anti-consumerist, frugal before & during retirement. The savings target is smaller, FI reached faster, but little room for luxuries.

Coast FIRE: Save enough early so investments grow on their own to full retirement value. Stop retirement contributions after target, work only to cover current expenses until full retirement age.

Example: Save enough by 40, stop saving, retire at 60.

Barista FIRE: Semi-retirement supplemented by part-time work. Live partly from investments and partly from low-stress / meaningful work, may keep health insurance via employer.

Fat FIRE: Luxurious retirement with high annual spending. Maintain or improve current lifestyle post-retirement. Requires high salary & aggressive investing.

Chubby FIRE: Comfortable retirement between Lean and Fat FIRE. Extra for moderate indulgences like travel or dining out.

Flamingo FIRE: Aggressively save early, then semi-retire and let investments grow while working lightly. Similar to Coast, but with extra spending money and reduced work intensity.

Example: Save heavily for 7-10 years, then work part-time until full FI.

Geo FIRE: Reach FIRE by moving to a low-cost area. Same savings go further, lifestyle varies by location.

Hobby FIRE: Early retirement funded partly by income from hobbies/passion projects. Work feels like play, income is supplementary, not essential.

For every FIRE type above, there is a multiplier of annual expenses needed. Usually between ~8-12x (e.g. Lean FIRE) to 50x (e.g. Fat FIRE).

Example of 25x expenses: $500K → $20K/year, $1M → $40K/year, $2.5M → $100K/year, ...

The 3 most populars are Lean Fire, Fat Fire, and Barista Fire. The coast is also popular. The others are more a blend of the previous ones.

I say I target Barista FIRE but it's more a blend of couples above that I will not divulge.

Even if you don't follow the FIRE movement or don't want to retire early, I think it's a good idea to manage your own retirement. I don't and I will not trust the government for that and there is one quote of Thomas Sowell that perfectly summarize that:

"No one will really understand politics until they understand that politicians are not trying to solve our problems. They are trying to solve their own problems—of which getting elected and re-elected are number one and number two. Whatever is number three is far behind."

They have short term visions. Some people have already mentioned the ratio between retiree vs employees that it's not good, and overtime, it will become problematic (maybe robots will fix that)...

If you are more interested in this topic, you should also look at a FIRE calculator which will be useful to see how much you need based on your stats.

Triforce

People use different strategies with their assets.

One popular is a blend of 50% of stocks and 50% of bonds (or 60%/40%).

Some companies or investment advisers will also suggest a specific plan by the time your target to retire and the portfolio will change over time ("more risky to less risky").

Example: VFIFX: Vanguard Target Retirement 2050 Fund

Some people will only use a Global World ETF that contains multiple companies across the world (e.g. VT / MSCI World ETF).

This one is less known and it's called the Harry Browne portfolio which is 25% stocks, 25% bonds, 25% cash and 25% in gold. A composition to "reduce risk".

My strategy is 3 assets which it's like the Triforce (consists of three separate triangles) in Zelda game franchises :P

I don't think I have the perfect portfolio or the perfect assets but it works well for me.

I would say diversification is very important in assets like stocks, bonds, estates, cash, gold, crypto, ...

Also in different areas (e.g. international) and countries / continents like USA, Europe, Asia, ...

You can also see a financial advisor but look carefully at the "hidden costs" (e.g. expense ratio) or fees.

Next Steps ?

So I moved from the 31st state (California) to the "51st" state a.k.a Canada :P

I know nothing about the west side of Canada but right now I really like it.

I probably built the best computer setup/lab I have in a dedicated room with a lot of devices.

I also have a backlog of 1000 years and I don't believe in full retirement so I expect to do a lot of projects.

Option for the next 7-8 years ?

- I will be dead

- will work in the resistance against Skynet

- A farmer

- Digital Nomad

- Freelancer++

- Releasing more Projects

- ...

I have a lot of options... Maybe a come back in USA in a couple of years since I like this country but I am not a citizen, or moving to South America or Asia, ...

I will also give an update through a blog post (probably yearly).

Right now for the weekend, I was thinking about restarting a game of The Legend of Zelda: A Link to the Past since it's been a long time since I didn't play this one. And probably restart a marathon of Alien and Predator franchises.

Thanks for reading,

JS.